Does EBITDA really tell you what you need to know?

“I have enough money to last me the rest of my life … unless I buy something.”– Jackie Mason

Does this sound like you?

Someone recently told me that they’re bored by finance. “Don’t distract me with strategic finance stuff, just let me run my business the way I know how.”

“No problem,” I said, “if you’ll just answer one question. What if the way you’re running it is causing increasing strain on your financial resources, cash flow is dwindling and you’re destroying market value every year. Do you care about any of that?”

“Of course, I do, but when sales start picking up again, all of that will go away and my EBITDA will return to normal levels.”

“Really?” I said. “How do you know that?”

“That’s the way it’s always worked.”

“Have you had any problems with your banking relationship?”

“A little, no different than anyone else, but they’ll get over it. Business will eventually return to normal and all will be well.”

Why do we care about Strategic Finance?

Our conversation continued but my friend was undaunted. “I’m going to do a free analysis of the last five years of your company,” I told him, “and I’ll report the results back in a few days. Let’s see if that approach is working for you.”

So, why are we talking about strategic finance at all? First, while we already know that “cash is king,” many executives still wonder why the profits they earn are not reflected in their cash balance. We’ll uncover some of those hiding places on this journey.

Do you think you’re creating value EVERY DAY?

Second, most business owners assume they’re creating value in their business every day. Wouldn’t it be a good thing to monitor whether that’s working as you intend and be able to periodically evaluate how the market values your company?

Third, there is a powerful educational component to this process. In an era of growing transparency, we can communicate our strategic and financial progress – in language everyone can understand – so that these principles can be applied throughout our business.

The Beast of EBITDA Must Die

So, it is with great anguish among financial reporters, and many of you, that the beast of EBITDA needs to be slain. It’s no surprise that our favorite cash flow champion, Warren Buffett, has been a long-time opponent of EBITDA. Just one example: since EBITDA is reported before interest expense, the growing interest costs that accompany mounting debt loads become invisible.

EBITDA is a TERRIBLE Placeholder for Cash Flow

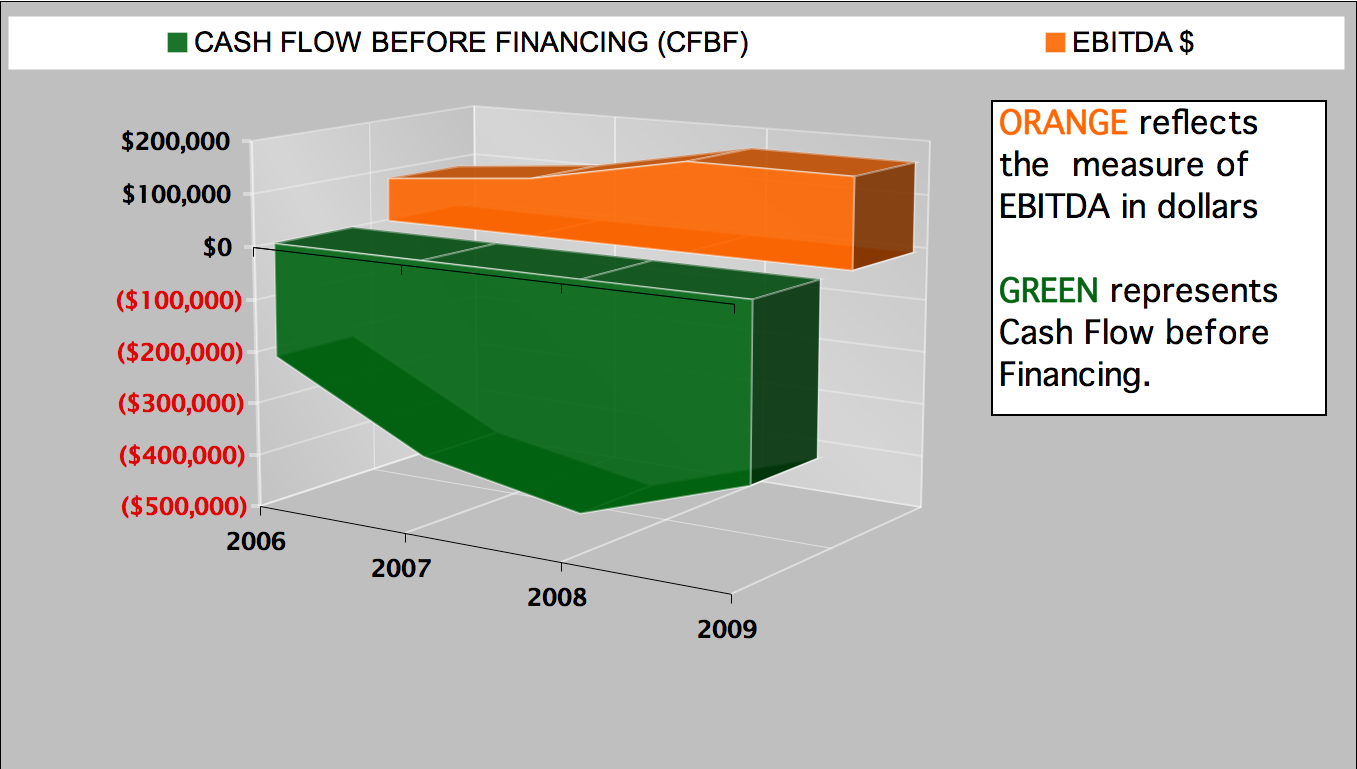

Most importantly, EBITDA invariably overstates real cash flow. In the picture shown in Exhibit 1, you’ll notice that the EBITDA measure has absolutely no connection to cash flow before financing. While the measure of EBITDA is positive and has grown over the last few years, cash flow before financing is a negative number.

Is this a fluke? Is this a real company you ask? Not exactly … it’s worse because it measures a composite of the 5.5 million U.S. companies that report their results to the IRS, including all 17,000 public companies in this country. While it accurately serves our dramatic purpose, it also illustrates how much EBITDA can vary from cash flow … and the relatively poor state of American industry.

The moral of the story is simple. Don’t use EBITDA as a placeholder for cash flow. It will mislead you far more than it will help you. So what is the cash flow that really counts? Stay tuned.