In my column appearing in the North Bay Business Journal June 30 edition, I continue the series exploring the financial challenges of accelerated growth. This particular column illustrates the value of financial analysis, but more broadly, should encourage you to make sure you have strong financial leadership in your organization. My experience is that many middle market businesses consider that investment as “indirect overhead” and not as a productive source of profitability. Nothing could be farther from the truth and for evidence, seek out the troubled companies that struggle because of the lack of meaningful financial information. When you find those that don’t think they need any, run the other way . . . or help them get some.

In my column appearing in the North Bay Business Journal June 30 edition, I continue the series exploring the financial challenges of accelerated growth. This particular column illustrates the value of financial analysis, but more broadly, should encourage you to make sure you have strong financial leadership in your organization. My experience is that many middle market businesses consider that investment as “indirect overhead” and not as a productive source of profitability. Nothing could be farther from the truth and for evidence, seek out the troubled companies that struggle because of the lack of meaningful financial information. When you find those that don’t think they need any, run the other way . . . or help them get some.

This column also points to pricing and promotion as important subjects that, in my experience, undergo very little analysis by middle market companies. You’ll find the book Why Popcorn Costs So Much at the Movies to be a fascinating tour through a variety of pricing puzzles. If you loved Freakanomics, which I did, you’ll find this book very engaging. You can find a quick overview of the book here.

This column also points to pricing and promotion as important subjects that, in my experience, undergo very little analysis by middle market companies. You’ll find the book Why Popcorn Costs So Much at the Movies to be a fascinating tour through a variety of pricing puzzles. If you loved Freakanomics, which I did, you’ll find this book very engaging. You can find a quick overview of the book here.

One more thing. You should also check out my earlier post about Dr. Steven Cuellar’s article about Price, Promotion and Profits, which is exactly on point to some of the issues raised in this column.

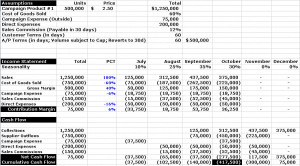

In the column, I refer to a more detailed schedule, which is shown below in Figure 1. (If you’d like to make the graphic bigger, just click on it and it will appear full size in a separate window). As you can see, this schedule presents an Income Statement and Cash Flow related to the special promotional program organized by Ace Business Stuff. The Income Statement is pretty straightforward but you’ll see that the seasonality factors play a major role. The supplier’s willingness to grant extended terms of 60 days for only a portion of the purchases is also significant but may not have been uncovered without the financial analysis performed by the controller.

For good reason, clients have heard me repeatedly say, with respect to cash flows, that “timing is more important than amount”. The amount of cash flow is less important since you’ll presumably get most of it eventually. Timing is more important because if you don’t receive the cash before you need it, how much you ultimately get doesn’t help pay the bills when they’re due. In this case, the seasonality and limited supplier support creates significant cash problems for a business that believed it was launching a very successful program.

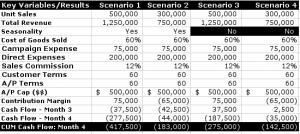

Figure 2 shows different scenarios that compare both the size of the campaign in terms of expected revenue as well as the seasonality factors. Scenarios 1 & 3, for example, reflect different seasonalities for the same size campaign while Scenarios 1 & 2 illustrate the same seasonality for two different size campaigns. The differences in profitability are understandably significant but the less understood cash impact is remarkably different as well.

Mr. Kirchenbauer,

I enjoyed your, “When ramping up a sales effort, terms, cash flow are key.” I allowed my subscription to the “North Bay Business Journal” lapse, but after reading your column, I’ll resubscribe.

Frank Borodic

Roundstone Farm Bed & Breakfast

(415) 663-1020