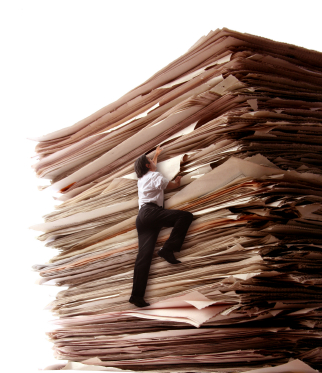

Like I’ve said, I certainly didn’t intend to wade into this health care reform quicksand but just the thought of a 2,000 page bill that legislators haven’t read conjures a paperwork morass that, like a stealth bomber, sneaks in under the radar and does incredible damage before you wake up in the morning …

Like I’ve said, I certainly didn’t intend to wade into this health care reform quicksand but just the thought of a 2,000 page bill that legislators haven’t read conjures a paperwork morass that, like a stealth bomber, sneaks in under the radar and does incredible damage before you wake up in the morning …

… not to mention how much stuff is buried in there we haven’t heard about yet or the laughable observations that it won’t cost anything. Where to start? How about David Broder’s observaations about its failure to deliver on cost controls, he being the former of Chief of Staff for Prez Clinton.

How about the Wall St. Journal report that the promised tort reform – sounds good – is coupled with a provision that provides incentive payments to states that adopt a “alternative medical liability law” … but ONLY IF it does not limit attorney’s fees or impose caps on damages”? Huh? Isn’t that at the core of tort reform in the first place?

How about the concept that none of this will cost anything because the savings will offset the cost? Gee, we’ve never heard that one before. For this part, start with Pelosi’s 5.4% income tax surcharge which turns into a 69% capital gains tax hike? Oops, haven’t heard of that one yet? It turns out that the Bush tax cut which resulted in the 15% capital gains rate will go to 20% when those tax cuts expire on Jan 1, 2011 … and go to 24.5% thereafter as a result of the surtax – a 69% bounce overnight.

Here’s some more frosting … that Sen. Harry Reid (D) is contemplating an increase in the Medicare payroll tax. The package was reportedly put together in secrecy and submitted to the Congressional Budget Office for analysis.

Health care reform is a worthy cause and much needs to be done. But wrapping the concepts in a labyrinth of bureaucracy buried in the conundrum of a 2,000 page bill, funded by an enigma of hidden tax schemes, is hardly the way to do it.