The NY Times today published an article surveying the multitude of indexes that have been proffered as measures of recessionary activity. More laxatives are sold - you can conjure why that is - more deodorant, more candy and whiskey, less...

Read More

The Freedom Recovery Plan? Not a bad idea . . .

Joe Nocera's column in today's New York Times refers to a plan put forward by Daniel Alpert of Westwood Capital to save the homeowner. It's the best plan I've read about because it doesn't require taxpayers to bail out homeowners,...

Read More

The chickens are crowding the roost!

Business Week calls it the The New Age of Frugality, something most of us knew was coming, or should have. We've all operated too long enraptured by the notion that "it's all coming up roses" even while the slow creep...

Read More

The sky is falling & unemployment drops too?

Anyone care to explain this? Although unemployment is up from one year ago, the jobless rate in EVERY SINGLE COUNTY IN CALIFORNIA dropped this month!Maybe Wall St. and our esteemed policy makers, who are by their actions prompting everyone to...

Read More

There are actually businesses doing business!

Finally, a mainstream magazine reminds us of the "Other Economy" that's out there. It's not constructed of toxic mortgages, clogged credit arteries or financial malfeasance. It's middle market companies doing what they do best – staying focused on what's important...

Read More

Vol. 27: You can bank on Sound Covenants

The North Bay Business Journal, a publication of the New York Times, is a weekly business newspaper which covers the North Bay area of San Francisco - from the Golden Gate bridge north, including the Wine Country of Sonoma and...

Read More

Who’s Watching Whom?

It won't take long to understand the dearth of regulatory results when you look at this graphic in today's New York Times, which traces the web of existing financial market regulators that already exists. Do we really think the federal...

Read More

How long can you stay on this tightrope?

Gretchen Morgenson from the NY Times writes in Sunday's paper about AIG in "Behind Biggest Insurer's Crisis, A Blind Eye to a Web of Risk". There are a lot of lessons here, mostly reminders of lessons you'd think were already...

Read More

The Philadelphia Plan

Before we applaud the federal government's intention to intervene in the mortgage markets - I don't mean the bailout plan but the reported idea of allowing judges to intervene between borrower's and their mortgage lenders – read the Success Seen...

Read More

I know. Let’s let the inmates run the asylum!

I referenced Joe Nocera last week - he's the NY Times columnist I mentioned in What's Next for the Capital Markets for his objective observations. This week, however, he seems to have moved from "This Bailout is like a Hail...

Read More

Ever try looking through quicksand?

If you'd like a little more insight into the staggering growth of the credit default swaps market and how this virus has infected so much of our financial system, you can read Out of the Shadows and Into the Harsh...

Read More

A pigeon and a stock trader are . . . .

Today's NY Times carried a refreshing article about the typically dark humor that usually accompanies difficult times. and this time on Wall Street. You can also visit the front page of this site to see the video that Warren Buffett...

Read More

Whose Money Should We Be Spending?

A little confused about all of the forces affecting the financial markets. Join the crowd. But, there are a few sources shedding more light than heat on these complex subjects and not hesitating to place the blame where it belongs....

Read More

Has the chicken come home to roost?

I wrote several columns in December last year, With Wall St. as Sideshow, Performance is Best Salary Guide, discussed the extraordinary exit strategies for Wall St. executives whose performance was dismal. In Even the Giants Don't Plan for Executive Succession,...

Read More

Is Technology Making us Smarter or Stupider?

Recently, an erudite friend of mine referred me to the provocative article by Nicholas Carr in the Atlantic Monthly, Is Google Making Us Stupid?Since both of us are avid readers, it was probative of our ability to continue to read...

Read More

What’s next for the capital markets?

It's anybody's guess. After spending several hours pouring through the Wall St. Journal and New York Times, Saturday editions, it's as clear as quicksand. On one hand, the proposed Federal program may offer a more stable platform to restore confidence...

Read More

Derivatives are the new “Greed” on Wall St.

The word "greed" has been tossed around this week like an ingot of hot ore. As I suggested in a recent post, the term can be applied equally to members of Wall Street and Main Street. There's plenty to go...

Read More

What is a short sale?

Many of you have written or called for an explanation of a short sale. Like most financial and trading concepts, there are simple explanations but the application of the concept is most often used in much more sophisticated and complex...

Read More

What happened? What happens now?

Before we can even catch our breath, we learn that the Fed has bailed out AIG to the tune of $85B to forestall an even greater calamity in capital markets across the world. [You can read about this everywhere but...

Read More

How to deal with unstable financial markets?

In my 35+ years, I have not seen a more dramatic day on Wall Street and the financial markets. Fundamental restructuring of the nation's leading investment banks leaves only two standing - Morgan Stanley and Goldman Sachs. The nation's largest...

Read More

The Leadership Forum: First Event a Success!

Earlier this year, in cooperation with the North Bay Business Journal, I organized The Leadership Forum as a platform within which we could address critical business issues where "Leadership Makes a Difference." Our fabulous team of sponsors made it a...

Read More

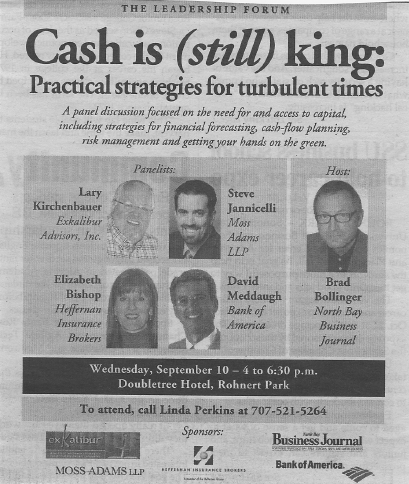

Cash is (still) King: Practical Strategies for Turbulent Times

Here is the newspaper ad that has been running weekly in the North Bay Business Journal to announce the upcoming event of The Leadership Forum. I will be moderating the event as well as serving as a contributing member of...

Read More

GTD Fans – check out Fortune magazine!

For aficionados of David Allen's GTD system for improved life productivity, an interesting article appeared in this issue of Fortune magazine, on newstands now. You can read the article here. A columnist interviewed Stephen Covey and David Allen looking for...

Read More

Business Journal hosts an expert seminar on Sept. 10

I will be moderating and participating on a panel presented by the Northy Bay Business Journal entitled: "Cash is (still) King: Practical Strategies for Turbulent Times". You can read more about it here.

Read More

Corporate Governance

Do you think that there is more time spent on process and protocol than thinking and inquiring at a recent Board meeting? As you may know, the Conference Board is one of the key places to visit for corporate governance...

Read More

Customers paying more slowly than usual? Yup!

A colleague passed along this article today, highlighting the collection problem in Corporate America, which is the worst since the 2001 recession. Maybe you need to hire this guy!

Read More

U.S. Export growth? Dramatic!

A recent NY Times article highlighted the extraordinary growth of U.S. exports - almost 20% higher than last year. It may not hold but the combination of a weak dollar and still-strong world economy has helped boost our exports, more...

Read More