What happens if we run out of cash?

“John, are you ready for our meeting? We said yesterday that we were going to meet to go over our financial projections and review a possible bank proposal.”

“I’ll be right there, Tom,” John Wilson, company CEO said to his controller.

John reflected on their conversation last week about the Company’s expected negative cash flow and the need to borrow from their bank, most of which resulted from giving extended terms to their customers.

John learned his lesson and wanted to avoid borrowing, but Tom had been pretty explicit about the need.

First, we need to review our short term cash needs

“John, I’ve gone over our short term cash needs again,” Tom said after they gathered in the conference room and were looking at some numbers on the overhead projector.

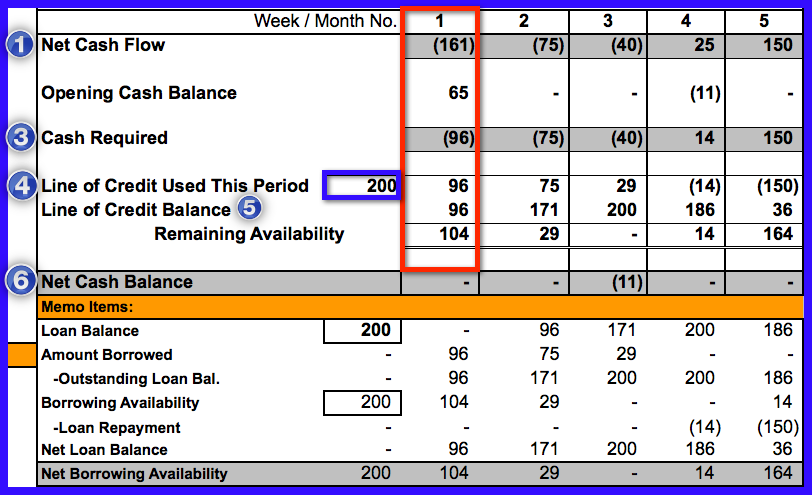

“I’ve created a simple example on the screen with all the numbers shown in thousands, which you can see in Figure 1 – Borrowing Availability, below.I’ve assumed a $200K line of credit (the number “200” is shown alongside the “Line of Credit Used This Period” in Figure 1, below, shown with a bright blue border).

“On Line 1 – Net Cash Flow, you can see the expected negative cash flow in the next three periods, of <$161,000>, <$75,000> and <$4,000>, respectively. [See Figure 1, below, to refer to these items. Line Numbers and Categories are bold-faced for easier reference. The numbers are shown in thousands.]

How much cash do we need?

[pullquote]“Creditors have better memories than debtors.” ~Benjamin Franklin[/pullquote]

“If you look on Line 3 – Cash Required, you’ll see how much cash we’ll need in excess of our Opening Cash Balance for each period. It reflects the money we need to pay our payroll and normal operating expenses on time.

“Line 4 – Line of Credit Used this Period, shows how much we’ll need to borrow in each period so that we have enough cash to cover those bills as well as the $150,000 Minimum Cash Balance we need to support our working capital needs.

“Below that is the new Line of Credit Balance (Line 5), and below that is our Remaining Availability to borrow against our line of credit.”

John Wilson, CEO, is struggling to get this

“Tom, I’m not following you.”

“Sorry, John.

“Take a look at Period 1 (marked with a bright red border) on Line 4 where you’ll see the borrowing of $96K, shown as Line of Credit Used This Period.

“The $96K on Line 3 – Cash Required represents the difference between the negative cash flow from our operations of <$161k> on Line 1 and our Opening Cash Balance of $65K in Period 1.

How much do we need to borrow to meet our needs?

“Line 4 – Line of Credit Used This Period shows us borrowing to meet that need,” Tom continued.

“A line of credit of $200,000 will give us enough money to get through the first two periods, but after that it gets pretty tight for a while.

“You can see on Line 6 – Net Cash Balance how much cash we have after borrowing.”

Can we borrow enough at the right time?

“Thanks, Tom, I’m with you. It looks like you’ve set up the financial model to borrow enough money to cover our cash needs and to show what borrowing power we have left.”

“That’s right, John.

“You can see from Line 3 that we need to borrow $40,000 in Period 3 to meet our cash needs.

“However, you can see that we’ve maxed out our $200,000 line of credit by then (see Line 5 – Line of Credit Balance) so we can only only borrow $29,000.

“In theory, we’ll have a negative cash balance of $11,000 (Line 6 – Net Cash Balance),” Tom said, “but we can probably manage that by deferring a few payables, but that’s not a sustainable policy.”

When does our cash flow return to positive?

“So, if I’m reading this right,” John asked, “the good news is that we return to positive cash flow in periods 4 & 5, our cash position starts improving again and we can even pay back some of our loan.”

“That’s right, John. It gets pretty close in period 3, but our borrowing capacity starts to grow after that. It improves because we expect to have a large, positive operating cash flow in the 5th period, when our receivables finally get collected.”

Do we qualify for a $200,000 line of credit?

“Tom, are we sure we can get a line of credit of $200,000? That’s your assumption, isn’t it?”

“Yes, I used a target line of credit of $200,000.

“In reality, our balance sheet is probably not strong enough to justify anything other than an asset-based loan.

“In that situation, the bank advances money as a percentage of our outstanding receivables and inventory.

“The line of credit will vary based on those balances each month, but it should be in that general ballpark.”

Do we need an Asset-Based Loan?

“Tom, I think I get the general idea but I do want the specifics. Can we reconvene this afternoon and go over the details? Maybe you could update this table to reflect how the loan availability changes based on inventory and receivables?

“You can also teach

me a little about an asset-based lending program and educate me about your concerns with our balance sheet. I really need to understand this. Can I check back you sometime after 3:00 p.m?”

“Sure, no problem, John. I’ll be waiting.”

Question: What’s your experience? Do you have borrowing capacity to deal with unexpected cash shortfalls? Do you have an early warning system to let you know about a cash crunch that may be coming?